Getting IRD (myIR) records for an unjustifiable dismissal claim: unfair dismissal lost wages evidence

Employee IRD Records for unfair dismissal case. myIR Account Login is required to obtain IRD records for quantifying unfair dismissl claims.

IRD income details are often the cleanest independent record of what income was reported and when. They can help quantify wage arrears, holiday pay, and lost wages, and can also expose gaps between what the employer says and what was actually filed with IRD.

When IRD records help

- Lost wages: checking earnings after dismissal (mitigation) and calculating claimed loss.

- Wage arrears: verifying what was paid vs what was owed.

- Holidays Act issues: cross-checking payments for annual leave and holiday pay.

- Trial period disputes: confirming whether the employee worked for the employer previously.

Why we may need your IRD Records from myIR

Employee Unfair Dismissal Case Form

Often we get cases where there are claims involving wage arrears and holiday pay owing. Cases involving unjustified dismissal or unjustified disadvantage where lost gross wages and holiday pay are being claimed will also require our employee client to obtain their IRD records from their former employer and subsequent employer to assist us in quantifying the amount claimed in remedy of their personal grievance.

We need to have a full picture on what Gross wages have been paid by an employer to our client employee so that we can make calculations in a more precise manner and we need to check what has been officially submitted to the Inland Revenue (IRD) by the employer.

Another example we commonly require IRD Records for is when we challenge a 90 Day Trial Period dismissal where an employee has previously worked for the employer and the IRD Records demonstrate previous wages paid to the employee before the trial period was entered into.

If you have been dismissed unfairly or you believe you are owed wage arrears and/or holiday pay, please fill out our Employee Unfair Dismissal Case Form.

Employee Unfair Dismissal Case Form

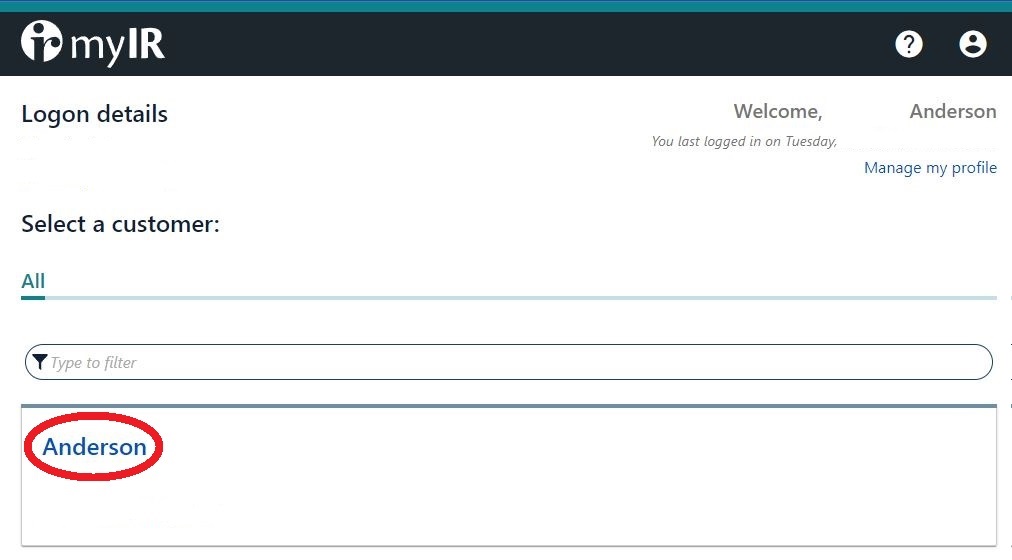

myIR Login

You will need to go to your MyIR or My IRD. Go to https://www.ird.govt.nz/ and click on myIR Login.

-

Log into the IRD website.

-

Click your name.

-

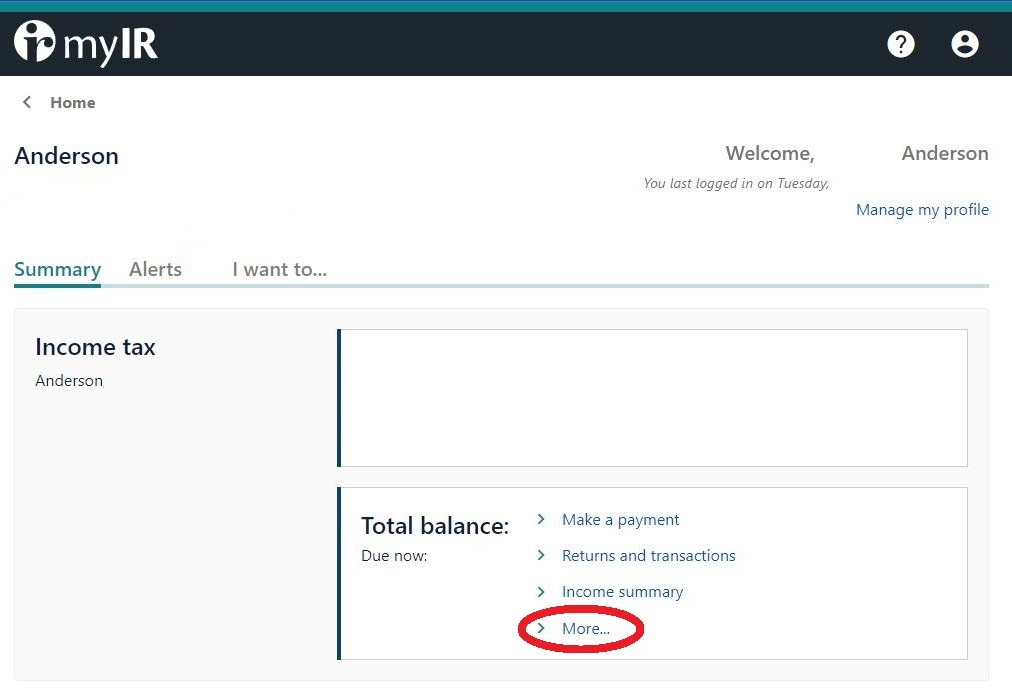

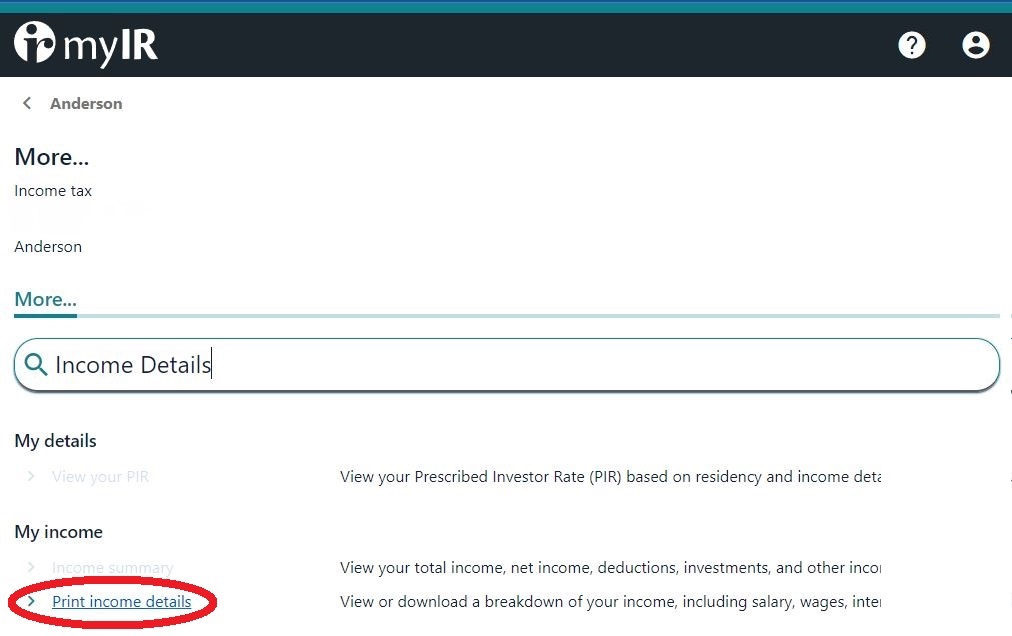

Click on the More button on the right-hand side of the Income tax.

-

Type Income Details in the filter box or search the list for it and then click on Print Income Details.

-

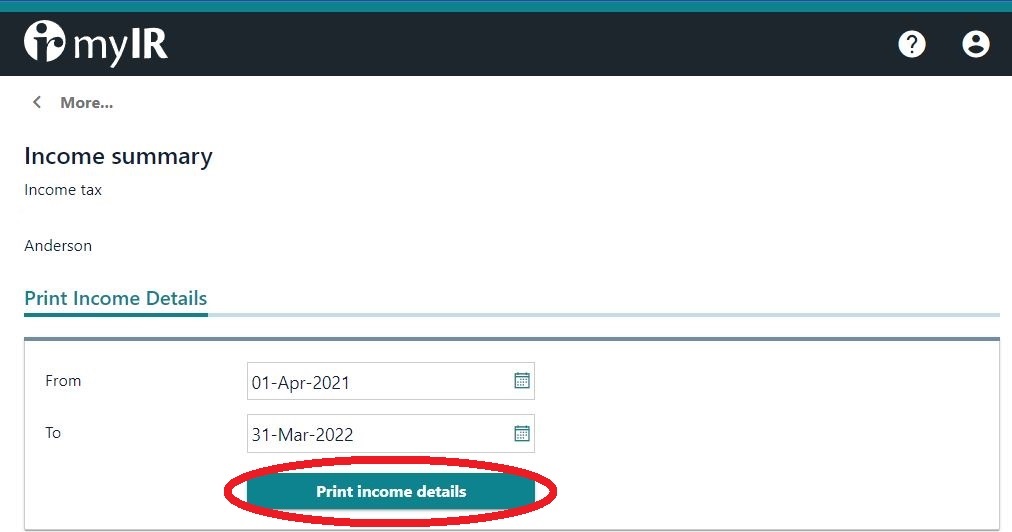

Alter the date range to be 1 month before the start of the range that is needed.

-

Click on Print Income Details.

-

Select the periods and click Print Income Details.

-

Then myIR will prepare a .PDF file for you with a breakdown of employers that paid you income.

Want us to quantify your wages and holiday pay claim?

Submit the case form with your timeline. If you can, also download your myIR income details (PDF) and keep your payslips and rosters.

Employee Unfair Dismissal Case FormRelated articles

Browse all articlesMedical incapacity dismissal: fair process and reasonable timeframes

Employers are not expected to keep a sick or incapacitated employee's job open for an indefinite period. The tests of fairness and reasonableness apply.

Evidence for unjustified dismissal personal grievance claims: what to collect

Unfair Dismissal and Personal Grievance cases require the employee to give evidence and provide clear and convincing proof to support their claim. Employee advice on evidence gathering.

Unjustified redundancy: when redundancy becomes an unfair dismissal personal grievance

The Employment Court upheld a determination of the Employment Relations Authority that an employer pay its former employee substantial compensation for hurt and humiliation in remedy of the redundancy having been found unjustifiable.

Who is the employer? identifying the true employer in NZ employment claims

Where there is confusion or ambiguity of the identity of the employer the legal test requires an objective observation of the employment relationship at its outset with knowledge of all relevant communications between employer and employee.

Recording workplace conversation in NZ: what is legal and what backfires

You do not need permission to record a conversation that you are party to but there are consequences that you may face later if you record conversations without permission.

Disciplinary meetings: employee rights and common employer mistakes

In a disciplinary meeting an employee has rights to procedural fairness and to be fairly heard. We represent employees at disciplinary meetings.